top of page

CENTER FOR A FREE ECONOMY NEWS

The Center for a Free Economy is actively advocating for common sense legislation that puts taxpayers first.

See below for a recent CFE news.

Interest on the National Debt Now Costs More Than Defense Spending

For the first time in U.S. history, the federal government is spending more on interest payments than on national defense. Annualized interest costs have reached roughly $1.2 trillion, surpassing about $1.16 trillion for defense. The cost of past borrowing now exceeds the cost of protecting the nation. This is not a theoretical warning. It is a budget reality. How the U.S. Reached This Point Decades of persistent deficits have steadily increased the national debt. For years,

Ryan Ellis

5 hours ago2 min read

Republicans Deliver a Real Spending Cut After Inflation

The U.S. House last week passed the final batch of fiscal year 2026 appropriations bills. Predictably, a wave of online criticism followed, claiming spending levels were too high and that House Republicans failed to deliver deeper cuts. That criticism ignores basic facts and misunderstands how federal budgeting works. First, year-over-year appropriations spending under these bills is set to grow more slowly than both overall inflation and nominal economic growth. That matters

Ryan Ellis

1 day ago2 min read

California Tries to Tax People Who No Longer Live There

California is pushing a legal theory that should alarm anyone who values mobility, federalism, and basic fairness in the tax code. A new lawsuit challenges whether a state can continue taxing income long after a taxpayer has left , raising serious constitutional questions about how far state tax authority can stretch. At the center of the dispute is California’s effort to tax income earned by former residents who have moved to states like Florida. The lawsuit argues that Cali

Ryan Ellis

2 days ago2 min read

The $6,000 Senior Deduction Explained

A claim circulating online says that seniors are receiving a new $6,000 “bonus exemption” worth $93 billion as part of the Working Families Tax Cut. The suggestion is that retirees are being handed a benefit comparable to what families receive through the Child Tax Credit. That claim is incorrect. The confusion stems from a basic misunderstanding of how the tax code works, specifically the difference between a tax credit and a tax deduction. They are not interchangeable, and

Ryan Ellis

3 days ago3 min read

How Modest Spending Restraint Fixes the Budget

The federal budget numbers since the pandemic make one thing clear. Washington does not have a revenue problem. It has a spending problem. From 2019 to today, federal outlays have surged by roughly 59 percent. Over the same period, federal revenue has risen by about 49 percent. Both are large increases. But spending has grown much faster, and that gap explains why the federal deficit has exploded. The deficit was already too high in 2019. Since then, it has roughly doubled. T

Ryan Ellis

6 days ago2 min read

SCORE Act Sets the Right Rules for College Sports

Congress has a clear choice on the future of college athletics. It can adopt a free-market framework that protects student-athletes and preserves competition. Or it can invite lawsuits, unionization, and federal micromanagement. H.R. 4312 , the Student Compensation and Opportunity through Rights and Endorsements Act, takes the right path. Name, image, and likeness policy is not the only area in need of reform. The same legal chaos now surrounds student-athlete transfers. Both

Ryan Ellis

Jan 223 min read

Virginia Democrats’ New Tax Would Punish Small Businesses First

Virginia Democrats are pushing a major state income tax increase that would not stay confined to the wealthy for long. House Bill 188 (HB 188) would create a new 10 percent Virginia income tax bracket on earnings above $1 million, sharply increasing the state’s top marginal rate on that income. Supporters sell the bill as a narrow tax hike on high earners. In reality, HB 188 would land squarely on Virginia farms, small businesses, and family-run companies that already operat

Ryan Ellis

Jan 212 min read

How the Tax Code Is Locking Up the Housing Market

Center for a Free Economy President Ryan Ellis recently published an op-ed in National Review Online explaining how outdated federal tax rules are worsening the housing shortage and squeezing middle-class families out of homeownership. High mortgage rates and elevated prices are only part of the problem. Federal tax policy is also reducing housing supply by discouraging homeowners from selling. An outdated rule is freezing supply Current law allows homeowners to exclude up

Ryan Ellis

Jan 202 min read

Trump’s 401(k) Down Payment Idea Comes With Important Tradeoffs

President Donald Trump has proposed allowing Americans to use their 401(k) retirement savings for down payments on homes, according to reporting by the Wall Street Journal . The goal is straightforward: help first-time buyers navigate a housing market where prices and mortgage rates remain elevated. That goal makes sense. But like many financial decisions, this approach involves real tradeoffs that families should understand before treating it as a go-to solution. Retiremen

Ryan Ellis

Jan 192 min read

SNAP Should Buy Groceries, Not Candy and Soda

As of this year, several states are blocking food stamp dollars from being spent on soda and candy. That change is overdue. Taxpayer-funded welfare exists to prevent hunger and malnutrition. It is not meant to subsidize junk food. This shift builds on reforms enacted last year, when Congress and President Trump tightened SNAP eligibility to reduce fraud and abuse. Those changes reinforced a basic principle: welfare programs should be targeted, conditional, and focused on gen

Ryan Ellis

Jan 162 min read

Trump Accounts Help Lower-Income Families Build Wealth Through Growth

Last year’s major tax law created a new tool for working families: Trump Accounts. Enacted as part of the Working Families Tax Cut passed by President Trump and the Republican Congress in July 2025, the policy is designed to do something Washington rarely does. It uses economic growth to build long-term wealth for every American child. The concept is straightforward. A modest, one-time deposit is made into an investment account at birth. That money is then allowed to grow, un

Ryan Ellis

Jan 152 min read

Why a 10% Rate Cap Would End Credit Card Perks

Capping credit card interest rates at 10% would not just change what borrowers pay. It would wipe out the rewards programs millions of Americans use every day. Points, cash back, airline miles, airport lounges, and statement credits all depend on today’s credit card pricing model. Take that away, and the perks disappear with it. That is not a theory. It is basic credit card economics. Rewards Are Paid for by Interest Margins Credit card rewards are not free. They are funded b

Ryan Ellis

Jan 142 min read

Price Controls on Credit Cards Would Backfire on American Families

A new proposal to cap credit card interest rates at 10% would not make credit cheaper. It would make credit disappear. According to a new study , nearly 90% of Americans would lose access to credit cards entirely if Washington imposes a one-size-fits-all rate cap. That is not consumer protection. It is a credit shutdown. A new analysis from the Electronic Payments Coalition finds that 175 to 190 million Americans would effectively lose their credit cards under a 10% annual

Ryan Ellis

Jan 133 min read

Obamacare Enrollment Stays Flat Because Subsidies Are Still Massive

Initial Obamacare enrollment for 2026 is roughly flat. That happened even as gross premiums jumped about 26 percent and COVID-era subsidy bonuses expired. This outcome is not a mystery. It reflects how deeply subsidized Obamacare already is and how enrollment rules hide real market signals. A new analysis from the Paragon Institute explains why Affordable Care Act enrollment barely moved despite higher prices and the end of temporary COVID add-ons. The reason is simple. The

Ryan Ellis

Jan 122 min read

High Prices Are Why Middle-Class Families Are Anxious

Middle-class families do not need lectures about inflation being “manageable.” They see the problem every month when they pay their bills. Cost-of-living pressure is real, persistent, and concentrated in the expenses households cannot avoid. Since November 2019, prices for basic necessities have surged far faster than overall inflation. Motor vehicle insurance costs have jumped 56.1 percent, the largest increase of any major consumer category. Utility gas service and motor ve

Ryan Ellis

Jan 92 min read

The Covid Mortgage Lock-In Is Finally Ending

The U.S. housing market just hit an important turning point that makes it easier for homeowners to sell and should increase housing supply over time. For the first time since the pandemic, there are now more homeowners with mortgage rates above 6% than homeowners holding sub-3% Covid mortgages . As of the end of 2025, 21.2% of existing mortgage holders are paying rates of 6% or higher. That is the highest share since 2015, and it now exceeds the share of ultra-low Covid-era l

Ryan Ellis

Jan 82 min read

Student Loan Debt Forgiveness Now Taxable

Student loan forgiveness is once again treated as taxable income . That is the correct policy. It restores a basic rule of the tax code and closes a loophole that would otherwise invite abuse. As reported by CNBC , the temporary exemption that allowed student loan forgiveness to escape taxation has expired. Going forward, borrowers whose loans are forgiven will owe taxes on that forgiven balance, just as they would with any other form of income. This outcome is not punitive.

Ryan Ellis

Jan 72 min read

Tariffs Hurt U.S. Manufacturing

Tariffs hurt U.S. manufacturing because imports are a critical input into American production. That basic fact is often ignored in trade debates, and it leads to policies that damage the very industries they claim to protect. Roughly half of all U.S. goods imports are not consumer products. They are industrial supplies and capital goods used by American manufacturers to produce goods, expand capacity, and invest in new equipment. Data from the U.S. Bureau of Economic Analysis

Ryan Ellis

Jan 62 min read

Trump Deregulation Delivers Real Savings for Working Families

President Trump closed the year with a clear message on affordability and Making America Great Again. The numbers now back it up. His administration is delivering one of the most aggressive deregulation efforts in modern history, and American workers and families are already seeing the benefits. New data show just how far Washington has shifted away from red tape and toward growth. In a single year, federal agencies finalized 646 deregulatory actions while issuing just five

Ryan Ellis

Jan 52 min read

School Choice Is Winning Over Blue States

Colorado Governor Jared Polis just said out loud what many Democrats quietly know. School choice works. That is why Colorado will opt in to President Donald Trump’s new nationwide school choice program. The program was created as a tax credit as part of the Working Families Tax Cut, passed by President Trump and the Republican Congress in July 2025. It is a pro-family reform that directs education dollars to students and parents, not entrenched systems. Polis put it plainly.

Ryan Ellis

Jan 21 min read

Working Families Tax Cut Makes 529 Plans More Powerful

Congress quietly delivered a major upgrade for families saving for education. The new tax law significantly expands how 529 plans can be used, making them more flexible, more practical, and better aligned with how students actually learn and train today. For families with children, or those planning ahead, these changes materially improve the value of saving through a 529 plan. What a 529 Plan Does A 529 plan is a tax-advantaged savings account designed to help families pay f

Ryan Ellis

Dec 31, 20253 min read

Two-Thirds of Obamacare Subsidies Don’t Go to Patients

Congress is once again debating whether to extend the enhanced, temporary Obamacare subsidies enacted during the COVID-19 pandemic under the Biden administration, layered on top of the law’s permanent subsidy structure. Doing so would be a costly mistake. Most of this spending does not help patients. It enriches insurers and fuels inefficiency. The numbers make this clear. A recent analysis highlighted by the Paragon Institute , drawing on new data from the Joint Economic Com

Ryan Ellis

Dec 30, 20252 min read

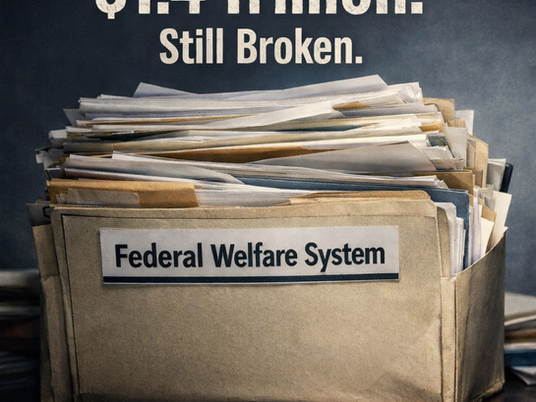

Minnesota Welfare Fraud Exposes a $1.4 Trillion System That Isn’t Working

The welfare fraud uncovered in Minnesota’s Somali community was not a minor scandal. Tens of millions of taxpayer dollars meant to help the poor were siphoned off with ease. That kind of abuse does not happen in a well-designed system. It happens when federal welfare programs are so large, complex, and poorly monitored that fraud becomes inevitable. That broader failure is the focus of a recent Wall Street Journal op-ed by Jason Riley , which argues that the real problem goes

Ryan Ellis

Dec 29, 20252 min read

Policymakers Should Help Working Families, Not Affluent Seniors

Source: SIPP; SHED (2022) Washington policy debates often assume seniors are the most financially vulnerable Americans. The data tells a different story. Seniors are the wealthiest age cohort in the country. By a wide margin. That outcome reflects decades of work, saving, and asset accumulation, and it should not be viewed as a failure. The real financial strain shows up elsewhere. Young families with children are far more likely to struggle with basic needs. Data shows young

Ryan Ellis

Dec 26, 20251 min read

Taxing Billionaires Won’t Balance the Federal Budget

Washington’s loudest voices calling to “tax the rich” keep selling the same fantasy. If billionaires just paid more, America’s debt problem would disappear. That claim collapses under even basic scrutiny. Even confiscatory tax hikes would not come close to solving the debt. The federal government could theoretically seize the entire wealth of every American billionaire and still fail to pay off even one fifth of the national debt. The math is not close. Meanwhile, the facts

Ryan Ellis

Dec 23, 20252 min read

Romney’s Tax Plan Is Class Warfare, Not Serious Reform

Conservatives were right to be skeptical of Mitt Romney. His latest tax proposals confirm why. In a recent New York Times op-ed , Romney argues for a new round of “tax the rich” policies. They are sold as deficit reduction. In reality, they raise little revenue, hammer economic growth, and rely on class warfare talking points instead of serious reform. The proposals read more like bumper-sticker economics than a workable tax plan. Sky-High Marginal Tax Rates on Work Romney’s

Ryan Ellis

Dec 22, 20252 min read

College Costs More, Delivers Less, and Leaves Too Many Graduates Unemployed

A new Bloomberg report puts a hard number on something families already feel in their gut. Americans with four-year degrees now make up 25.3 percent of all unemployed workers . That is the highest share on record. When one in four unemployed Americans holds a bachelor’s degree, the system is not working. People say “college is a scam” for a reason. It is not because they oppose education. It is because colleges have spent years drifting away from their mission while driving

Ryan Ellis

Dec 19, 20252 min read

Giant Corporate Hospital Networks Are Stealing From Rural America

Rural America should be furious. Hospital lobbyists pushed lawmakers to create loopholes that let big city hospital systems pretend to be “rural” so they can siphon off money meant for small-town care. That abuse sits at the center of the “340B” drug price discount program. What was designed to support genuinely rural and safety-net hospitals has been warped into a profit engine for large, urban hospital networks that know how to work Washington. Through technical classificat

Ryan Ellis

Dec 18, 20252 min read

Tariffs Are Dragging Down Trump’s Economic Approval Rating

President Trump’s approval rating on the economy is slipping, and the reason is not hard to find. According to a new AP-NORC poll, voters are souring on tariffs. That dissatisfaction is bleeding directly into broader views of Trump’s economic performance. The poll, reported by the Associated Press, shows Trump facing weaker approval on economic stewardship even as inflation concerns ease and job growth continues. The common thread behind the decline is trade policy. Voters in

Ryan Ellis

Dec 17, 20252 min read

Free Markets Beat Tariffs and Bailouts Every Time

Tariffs always come with a predictable sequel. First, Washington imposes new taxes on imports in the name of toughness. Then, when the economic damage becomes impossible to ignore, taxpayers are asked to clean up the mess. That cycle is playing out once again in American agriculture. A recent National Review op-ed by Dominic Pino explains the problem clearly. In “Trump Bails Out the Farmers He Kneecapped With Tariffs Again,” Pino details how tariffs raised costs, shrank exp

Ryan Ellis

Dec 16, 20252 min read

Senate Lets COVID-Era Obamacare Super Subsidies Expire

Washington keeps reaching for the same failed solution in health care: bigger subsidies for a system that is already too expensive and too insurer-driven. That approach took a hit last week when the U.S. Senate rejected an extension of the COVID-era Obamacare “super subsidies.” The vote was a reminder that affordability will not be fixed by writing bigger checks to big insurance companies. Real reform has to start with empowering patients. As reported by the Associated Press

Ryan Ellis

Dec 15, 20252 min read

5 Steps to Lower Health Care Costs

Families need real relief from high health-care costs. They are tired of Washington’s habit of pouring more Obamacare tax dollars into a system that keeps getting more expensive. There is a better way. A new five-point platform from the Committee to Unleash Prosperity shows how we can make care more affordable without writing bigger checks to Big Insurance. Their plan is simple and targeted. It focuses on giving patients more control, expanding choices, and opening the syste

Ryan Ellis

Dec 12, 20252 min read

Obamacare Is Handing Out Tax Credits With No Identity Verification

Families expect federal programs to follow basic rules. They expect taxpayer money to be protected. They expect the government to check whether a person is who they say they are. This week, the Government Accountability Office (GAO) showed that the Obamacare marketplace is failing that test in stunning fashion. GAO released the results of a covert audit that should alarm every lawmaker. Investigators created four completely fictitious identities and attempted to enroll them

Ryan Ellis

Dec 11, 20251 min read

Obamacare Fraud Shows Why Real Reform Cannot Wait

A new investigation from the Government Accountability Office (GAO) should be a wake-up call for anyone who still thinks Obamacare is working as promised. House Ways and Means Committee Chairman Jason Smith highlighted the findings in a recent appearance on CNBC , and the results are hard to ignore. Fake applicants were approved. Dead enrollees kept receiving subsidized coverage. One Social Security number was tied to more than 125 different insurance policies. That is not

Ryan Ellis

Dec 10, 20251 min read

Congress Has a Chance to Finally Hold PBMs Accountable

Patients deserve a prescription drug market that is open, honest, and affordable. For too long, pharmacy benefit managers have operated behind a wall of secrecy that hides how they make money and why drug costs keep climbing. The bipartisan Pharmacy Benefit Manager (PBM) Price Transparency and Accountability Act , introduced in the U.S. Senate by Sens. Ron Wyden and Mike Crapo, offers a clear path to fixing that. This bill tackles one of the biggest drivers of high drug pric

Ryan Ellis

Dec 9, 20252 min read

Now Is the Time for a Second Reconciliation Bill

Washington has a chance to deliver real relief to families who are struggling with high prices and limited choices. Last year’s reconciliation bill made some progress, but it did not finish the job. The Republican Study Committee is right to call this moment what it is: an opportunity to lead and to deliver on the promises made to hardworking families. A second reconciliation bill should focus on three priorities. We need further tax relief. We need patient-centered health c

Ryan Ellis

Dec 8, 20252 min read

Washington Faces a Simple Test: Keep Temporary Spending Temporary

The Wall Street Journal reports that Speaker Johnson is signaling caution toward a push to extend the COVID-era boost to Obamacare premium subsidies. That caution is warranted. These subsidies were created as a temporary response to the pandemic, and they should expire on schedule. Conservatives are right to oppose any attempt to extend them. If a program was created as a short-term emergency expense, it needs to remain short term. For years, both parties have papered over f

Ryan Ellis

Dec 5, 20251 min read

Trump Takes a Bite Out of Rx Drug Foreign Freeloading

Britain now plans to spend more on new medicines so it can keep tariff-free access to the U.S. market. That simple tradeoff marks real progress. President Trump is pushing a clear message: the era of foreign freeloading on American drug innovation is ending. For years, U.S. patients and taxpayers have shouldered the cost of developing new cures while other countries imposed strict price controls and paid far less. The Wall Street Journal reports that the UK agreed to higher

Ryan Ellis

Dec 4, 20251 min read

Momentum Builds for Trump Accounts

Families want a real path to savings, investment, and long-term opportunity. Trump Accounts offer that path, and support for the idea is growing. A recent CNBC report highlighted a major commitment from Michael and Susan Dell to help seed these accounts for millions of children. Their $6.25 billion donation would give 25 million kids an early start on wealth building. The Dell commitment shows that serious private leaders see real potential in Trump Accounts. When investors

Ryan Ellis

Dec 3, 20251 min read

The U.S. House Is Voting on the SCORE Act This Week. Conservatives Are United Behind It.

The U.S. House is set to vote this week on H.R. 4312, the Student Compensation and Opportunity through Rights and Endorsements (SCORE) Act. This is a chance to bring clarity and common sense to name, image, and likeness rules in college sports, an area that has become chaotic and inconsistent without a national framework. Center for a Free Economy organized a coalition letter urging House leadership to pass the SCORE Act. Many conservative groups joined because student-athlet

Ryan Ellis

Dec 2, 20252 min read

The Fed Finally Cuts the Red Tape

The Federal Reserve took an important step by acknowledging that its supervisory process has grown too dense to be useful. That is a welcome shift toward clarity and restraint. The Fed now says banks may not need a 47-page checklist to prove they are doing basic banking. The Associated Press covered the change here . The point is straightforward. More forms do not make the system safer. Clear priorities do. Efficiency is a risk-management tool, and regulators are finally trea

Ryan Ellis

Nov 28, 20251 min read

Taxpayers Are Headed for Larger Refunds. Washington Should Not Get in the Way.

Families are stretched thin. Every trip to the grocery store or gas station reminds them that the cost of living climbed faster than their paychecks. So here is one piece of good news that Congress should not ignore: Tax refunds are on track to rise in 2026. A new study from Piper Sandler, using data from the Joint Committee on Taxation, shows what is coming. For the 2026 tax filing season, taxpayers are expected to take home an additional $91 billion in refunds. Workers will

Ryan Ellis

Nov 25, 20251 min read

Tariffs Didn’t Fix the Trade Deficit. They Just Made Life More Expensive.

Families feel the squeeze every time they shop for groceries, buy school supplies, or pay the monthly bills. Politicians promised that new tariffs would bring back jobs, lower costs, and shrink the trade deficit. They said tariffs were the cure. They were not. The numbers tell the real story. Creative Planning looked at U.S. trade data through the first eight months of each year. In 2024, America ran a $571 billion trade deficit. One year later, that deficit did not shrink.

Ryan Ellis

Nov 24, 20252 min read

Why is Congress Ignoring a Health Care Cost Saver Hiding in Plain Sight?

Most families feel squeezed every time they look at their health insurance bill. Premiums keep climbing, choices keep shrinking, and Washington keeps pretending that Obamacare is the only game in town. It is not. Congress can act right now to make health insurance about 60 percent less expensive for millions of people. The solution already exists. Lawmakers only need to lock it in. A few years ago, the Trump administration created a regulation that allowed people to buy short

Ryan Ellis

Nov 21, 20252 min read

Conservative Groups Push Congress to Pass Common Sense PBM Reforms

Two dozen conservative groups sent the following letter to Congressional leadership. The text of the letter is below: The undersigned...

Ryan Ellis

Sep 23, 20253 min read

Conservative Groups Push Back Against Big Government Collusion with Non-Profit Hospital Networks

The following letter (signed by over 40 conservative groups including the Center for a Free Economy, Americans for Tax Reform, National...

Ryan Ellis

Jul 23, 20252 min read

Center for a Free Economy Keyvotes H.R. 1, the One Big Beautiful Bill Act

Endorsement letter is here . The Center for a Free Economy is pleased to endorse H.R. 1, the “One Big Beautiful Bill Act (OBBBA).” The...

Ryan Ellis

Jul 2, 20252 min read

U.S. House Should Pass the Budget Reconciliation Bill Before the Memorial Day Recess

The U.S. House of Representatives is gearing up to pass the "One, Big, Beautiful" budget reconciliation bill. It's a conservative bill...

Ryan Ellis

May 16, 20252 min read

U.S. House Ways and Means Committee Passes "One Big Beautiful Bill" for Taxpayers

This week, the U.S. House Ways and Means Committee passed out of committee tax reform legislation to make permanent and broaden the Tax...

Ryan Ellis

May 14, 20253 min read

Why Congress Must Pass the Tax Reform Bill for Economic Growth

This week, the U.S. House Ways and Means Committee will advance tax reform legislation to make permanent and broaden the Tax Cuts and...

Ryan Ellis

May 12, 20253 min read

bottom of page